Tłı̨chǫ Friendship Centre On Land Healing & Wellness (Feb. 6-10)

Date:

Time:

Location:

Community:

GROUP PARTICIPANTS: Eligible participants must be at least 18 years old. The program is limited to a maximum of 20 participants and is open to all genders.

- Food, accommodations, and blankets will be provided by the centre.

- Gifts and prizes will be awarded to the participants.

When: February 5 to 9, 2025

Where: Bobby’s Miqwi Camp

For more information, please don't hesitate to contact us. Applications will be at the Front Desk at the Tłı̨chǫ Friendship Centre.

Bipin Dhakal

T: 867-392-6000 EXT. 105

Terri Naskan

T: 867-392-6000 EXT. 104

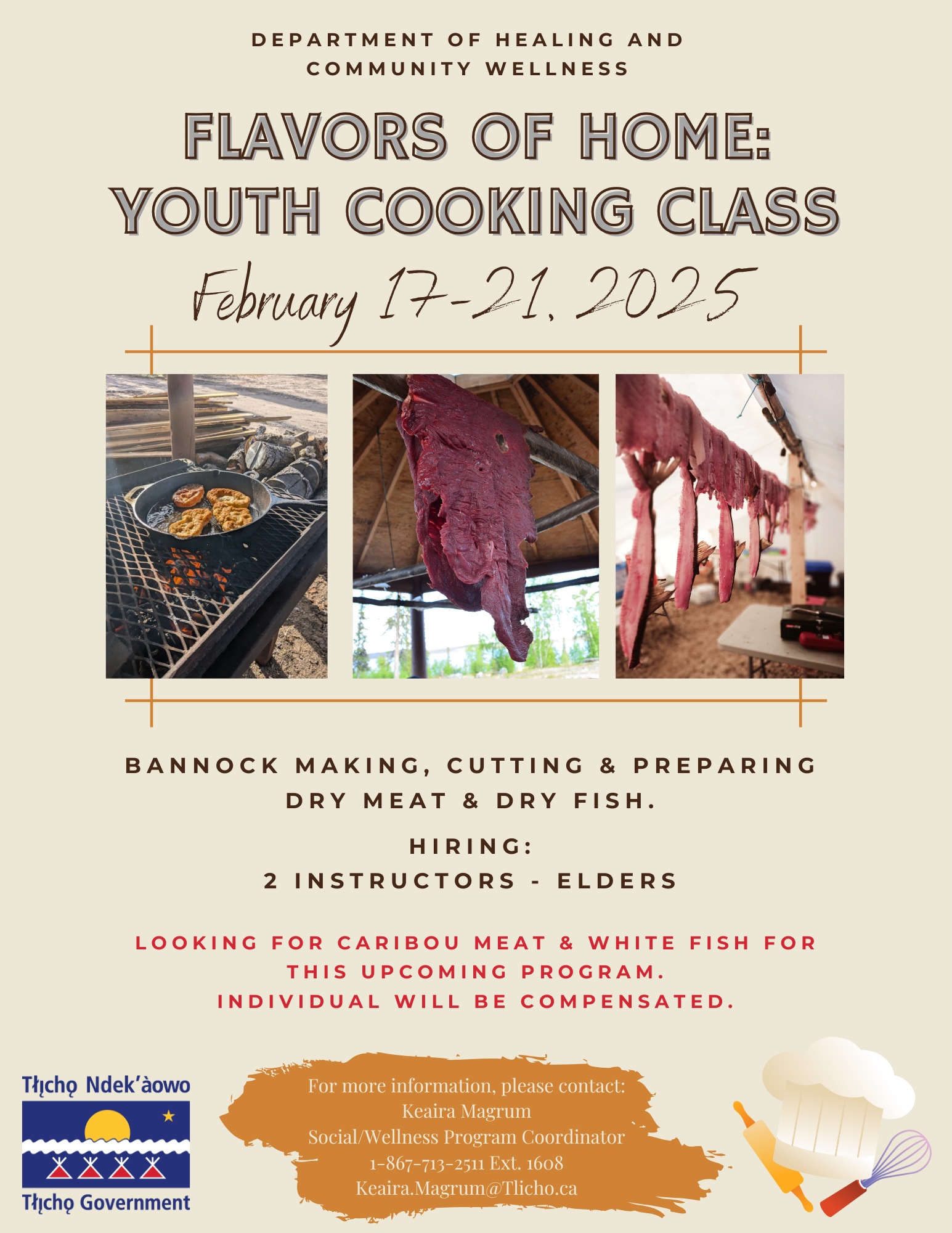

FLAVOURS OF HOME: YOUTH COOKING CLASS

Date:

Time:

Location:

Community:

Bannock making, cutting & preparing dry meat & dry fish

Hiring:

- 2 instructors - elders

- Looking for caribou meat & white fish for this upcoming program

- Individual will be compensated

For more information, please contact:

Keaira Magrum

Social/Wellness Program Coordinator

T: 867-713-2511 Ext. 1608

E: [email protected]

We're Hiring: Custodian - Wekweètì

Date:

Time:

Location:

Community:

OUTLINE OF POSITION:

The Custodian reports to and takes direction from the Community Director; is responsible for performing custodial, minor maintenance and other miscellaneous duties; to the Community Presence Offices’ building and its’ facilities; to ensure they are maintained in a healthy, safe and sanitary manner for all the staff, members and general public; and is expected to and must follow the standard Tłı̨chǫ Government Administrative Policies and Procedures.

EDUCATION, EXPERIENCE, SKILLS REQUIRED:

- Related work experience

- Ability to work under little supervision

- Good problem-solving abilities

- Ability to read and understand cleaning chemicals and products labels and instructions

- Knowledge of the standard cleaning procedures, chemicals, products and equipment

- Must have Workplace Hazardous Materials Information System Certificate (with the ability to re-certify as needed)

- Ability to use the English and Tłı̨chǫ languages is an asset

- Familiarity with the Tłı̨chǫ language, culture and way of life

To apply, send your resume + cover letter or to request Job Description; [email protected]

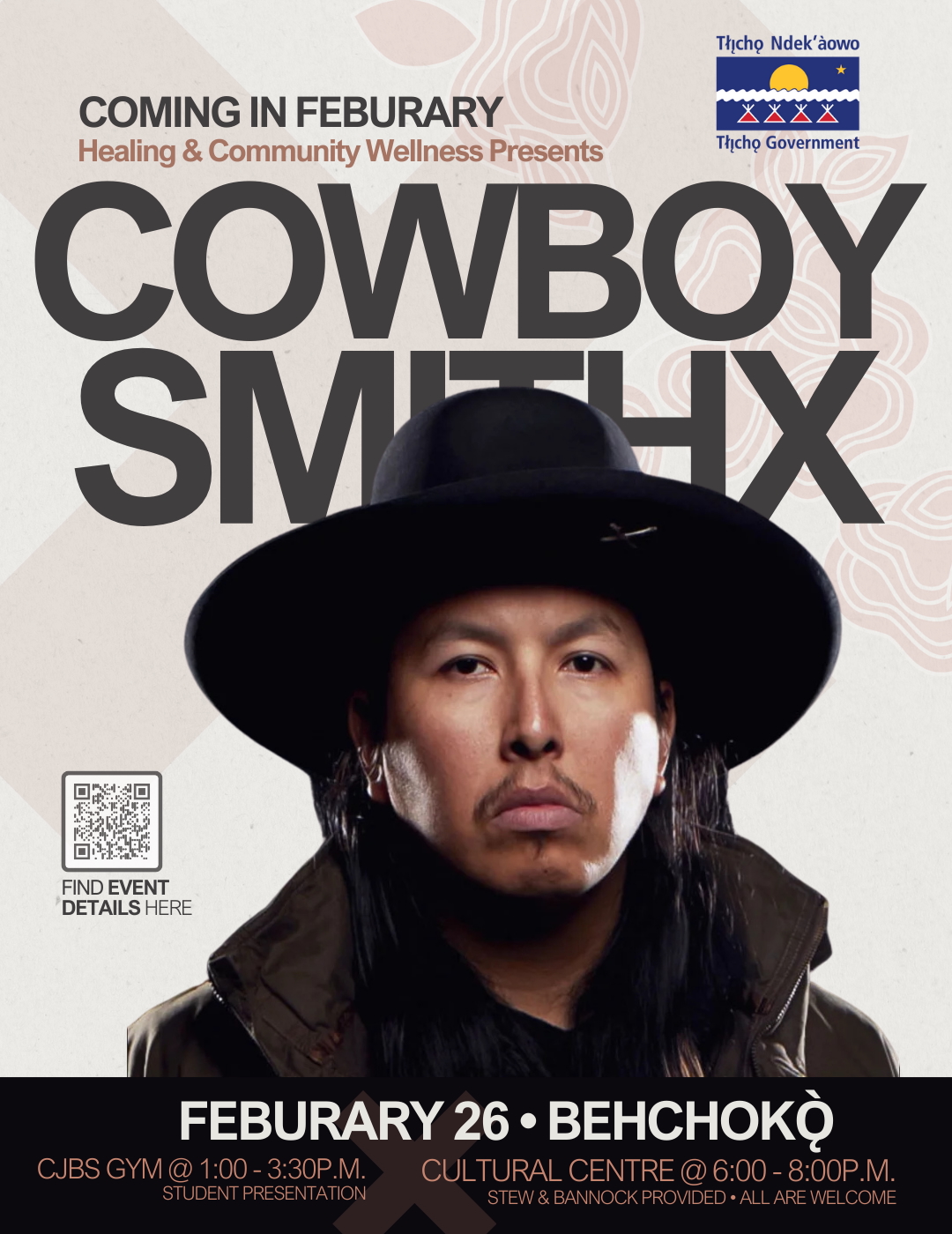

SPECIAL PRESENTATION: COWBOY SMITHX

Date:

Time:

Location:

Community:

Prepare to embark on a spiritual journey as Behchokǫ̀ welcomes Cowboy SmithX.

Learn how to reconnect and form a deeper connection to your indigenous culture and use it to capture opportunity, fulfillment and meaning while navigating a world full of ever-changing obstacles and challenges.

Join us in Behchokǫ̀ for a special presentation and community gathering - February 26, 2025

Cowboy SmithX will appear at two events:

- CJBS School Gym @ 1:30 - 3:00P.M. (Student presentation)

- Cultural Centre @ 6:00 - 8:00 P.M. (Community presentation)

Join us for stew & bannock durning the evening presentation at the Cultural Centre. All are welcome.

For more information, contact

Department of Healing & Community Wellness

T: 867-392-6381 Ext. 1371

E: [email protected]

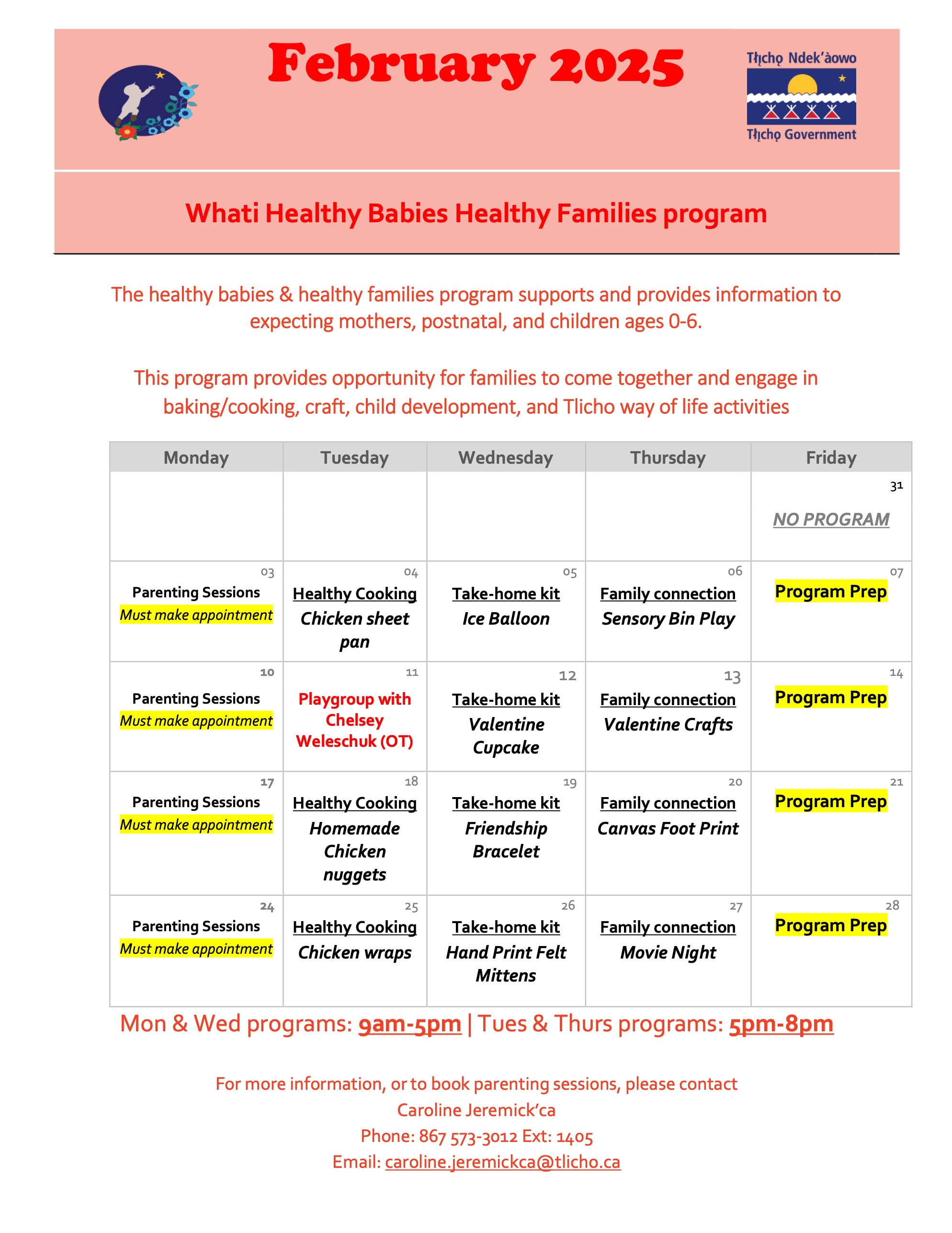

Whatì Healthy Babies Healthy Families Program - February 2025

Date:

Time:

Location:

Community:

The Healthy Babies & Healthy Families Program supports and provides information to expecting mothers, postnatal, and children ages 0-6.

This program provides opportunity for families to come together and engage in baking/cooking, craft, child development, and Tlicho way of life activities

Mon & Wed programs: 9am-5pm | Tues & Thurs programs: 5pm-8pm

For more information, or to book parenting sessions, please contact Caroline Jeremick'ca

Phone: 867 573-3012 Ext: 1405

Email: [email protected]

Behchokǫ̀ Aboriginal Early Head Start (0-3 years) - February 2025

Date:

Time:

Location:

Community:

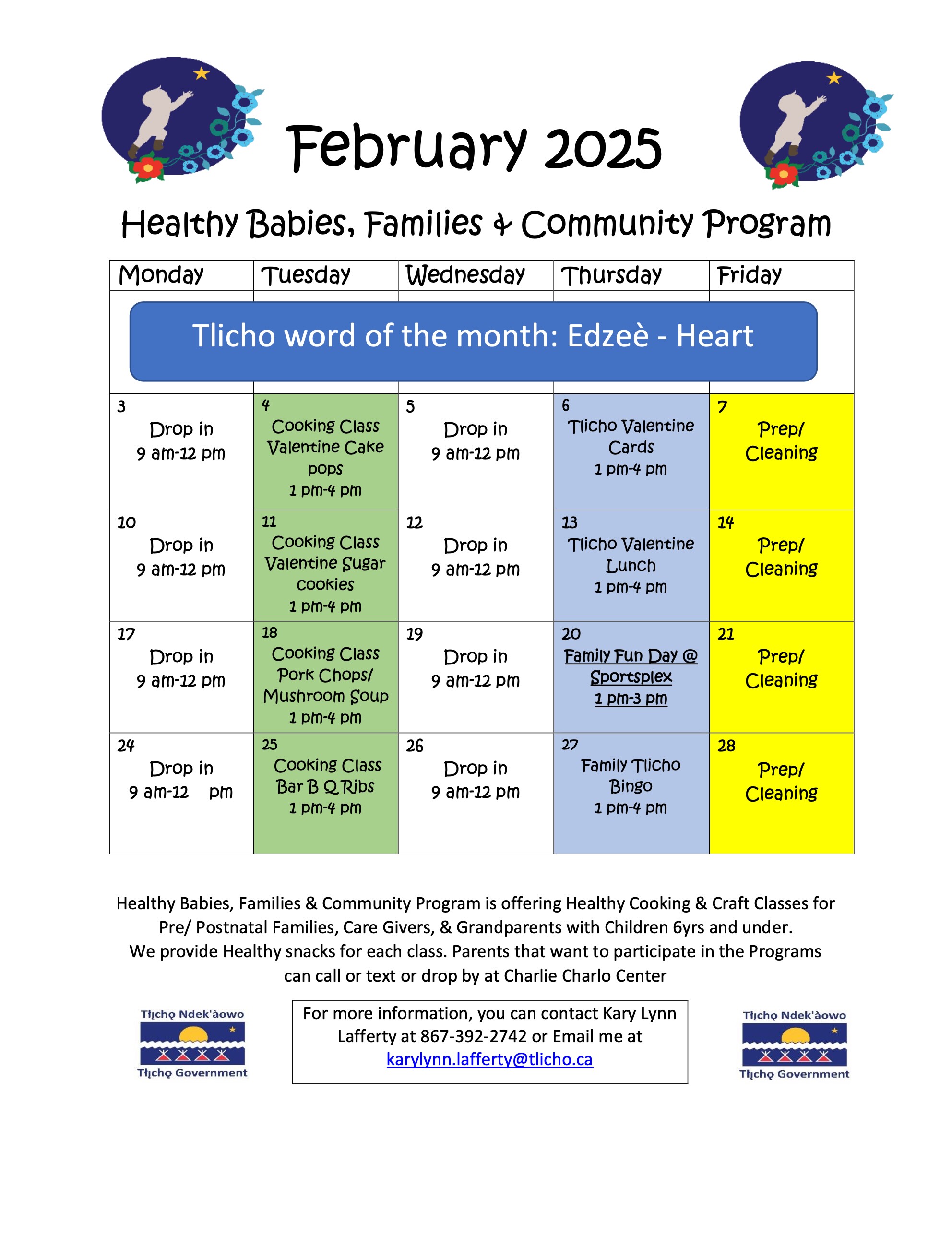

February is indigenous language month - The Tłı̨chǫ word of the month is: Edzeè (Heart)

Location: Charlie Charlo Building

Contact # 492-4665

Healthy Babies, Families & Community Program - February 2025

Date:

Time:

Location:

Community:

Healthy Babies, Families & Community Program is offering Healthy Cooking & Craft Classes for Pre/ Postnatal Families, Care Givers, & Grandparents with Children 6yrs and under.

We provide Healthy snacks for each class. Parents that want to participate in the Programs can call or text or drop by at Charlie Charlo Center

For more information, you can contact Kary Lynn Lafferty at 867-392-2742 or Email me at [email protected]

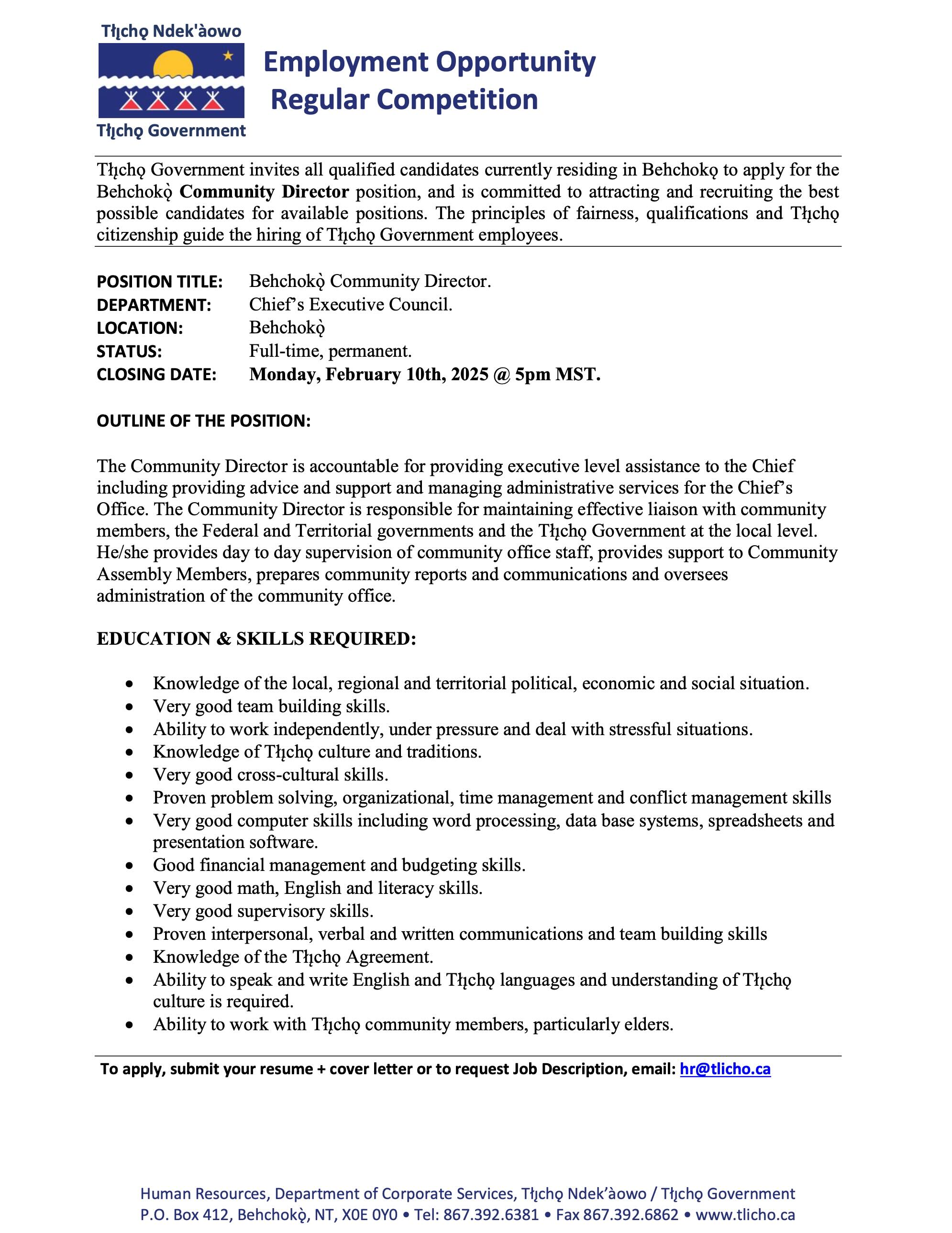

We're Hiring: Behchokǫ̀ Community Director

Date:

Time:

Location:

Community:

Tłı̨chǫ Government invites all qualified candidates currently residing in Behchokǫ̀ to apply for the Behchokǫ̀ Community Director position, and is committed to attracting and recruiting the best possible candidates for available positions. The principles of fairness, qualifications and Tłı̨chǫ citizenship guide the hiring of Tłı̨chǫ Government employees.

OUTLINE OF THE POSITION:

The Community Director is accountable for providing executive level assistance to the Chief including providing advice and support and managing administrative services for the Chief's Office. The Community Director is responsible for maintaining effective liaison with community members, the Federal and Territorial governments and the Tłı̨chǫ Government at the local level.

He/she provides day to day supervision of community office staff, provides support to Community Assembly Members, prepares community reports and communications and oversees administration of the community office.

EDUCATION & SKILLS REQUIRED:

- Knowledge of the local, regional and territorial political, economic and social situation.

- Very good team building skills.

- Ability to work independently, under pressure and deal with stressful situations.

- Knowledge of Tłı̨chǫ culture and traditions.

- Very good cross-cultural skills.

- Proven problem solving, organizational, time management and conflict management skills

- Very good computer skills including word processing, data base systems, spreadsheets and presentation software.

- Good financial management and budgeting skills.

- Very good math, English and literacy skills.

- Very good supervisory skills.

- Proven interpersonal, verbal and written communications and team building skills

- Knowledge of the Tłı̨chǫ Agreement.

- Ability to speak and write English and Tłı̨chǫ languages and understanding of Thcha culture is required.

- Ability to work with Tłı̨chǫ community members, particularly elders.

To apply, submit your resume + cover letter or to request Job Description, email: [email protected]